Generation Z are the most financially savvy generation we’ve ever known. It’s clear they have watched and learnt from the mistakes of their parents and grandparents when it comes to credit and lending and as such are demanding a change. The first true digital natives, Gen Z not only expect, but demand, transparency and business in all industries have little choice but to adapt to cater for this if they want to keep up.

In this article I want to explore how Gen Z’s are forcing credit providers – old and new – to lend responsibly and outline how Buy Now, Pay Later (BNPL) providers can provide the best service possible for Gen Z’s in the most responsible way.

Who are they, the digital natives?

The digital natives, Gen Z, are younger than 25 and older than 13. They’re the first generation born with technology and unlike generations before them it is as natural to them as the air they breathe; it’s always been around and life without it – well, what is that?

As well as their digital ease, Gen-Z have shown they care about sustainability across all industries from looking after their environment to rejecting small-print terms and conditions with hidden messages. The savvy generation rightly have high expectations of companies and services they use – sub-par is simply not good enough for them.

When it comes to credit, the demand for transparency has resulted in the fine print and incohesive terms and conditions no longer being acceptable, with Gen Z wary of borrowing responsibly and not being blindsided into any payments or fees they cannot afford to pay back.

That’s why Zilch takes affordability very, very seriously – Zilch had to be born with regulation in mind. We’ve had responsibility in our DNA from the start. To that end, we’ve worked closely with the FCA for 12 months and are proud to be named the first fully FCA regulated BNPL provider in the UK.

The credit crunch that no Gen Z wants to be a part of…

The global financial crisis in 2008 saw excessive risk-taking by banks combined with the burst of the housing bubble result in the fall of economies globally – a crisis that would take years to amend (and arguably longer). Mistakes made in the past have, rightly, given Gen Z a cynical attitude when it comes to borrowing and importantly those lending. Many are choosing not to borrow at all, and those that do, demand transparency and clarity rather than 12 pages of terms and conditions in font size 6. And so they should.

While generations before have had a more detached view of their finances, most Gen Z savers check their bank balance at least once a day. They’re also more likely to use no-fuss banking apps that allow them to move their money around between their accounts and know exactly how much they are spending and saving.

The shopping revolution – this is it.

Learning from the past, Gen Z are abandoning traditional credit and here’s why: traditionally BNPL providers have relied on retailers to distribute their offering, which means they are competing for merchant partnerships. It also means, when a customer comes to pay they have multiple providers to choose from. Aside from being a busy and fragmented process, this can also result in shoppers flicking between payment sources and quickly find themselves balancing multiple payment timelines from multiple different BNPL providers (who don’t talk to one another). It goes without saying this makes it difficult to keep track and they are more likely to miss a payment deadline.

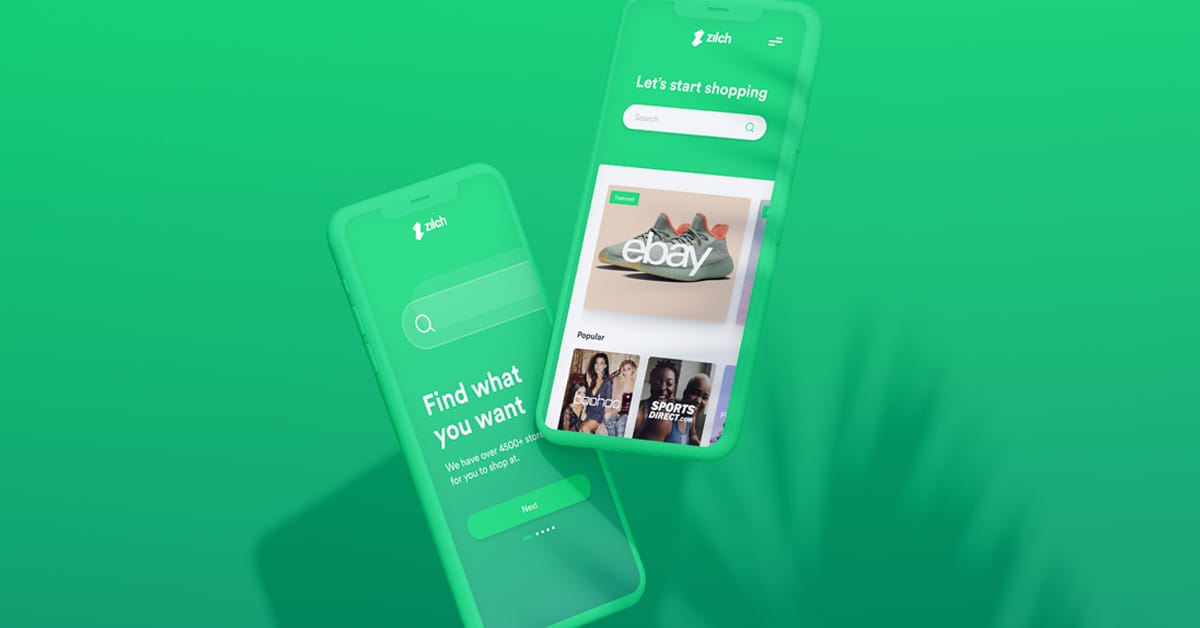

Now is the time to consider the customers first. At Zilch, this is the fundamental difference that separates our business model from traditional players in the industry. Zilch is retailer agnostic, which means we focus solely on the customer which in turn brings value to the retailer (not the other way around).

Another core part of the shopping revolution is utilising open banking. This service has become a crucial element of financial services globally, yet many BNPL providers have been slow out of the blocks when it comes to adopting this technology. So much so, Zilch is currently the only BNPL player to take advantage of Open Banking Technology combined with soft credit checks. This enables a real-time view and understanding of a customer’s affordability (not just their creditworthiness), which means never lending a customer more than they can afford to pay back and it removes the possibility of indebtedness and credit related anxiety.

What does the ‘new world’ look like?

Streamlining payments and simplifying the lives of Gen Z customers with a merchant agnostic approach will give Gen Z customers the freedom to shop wherever they like without the stress of dealing with a convoluted mixture of providers (think in-store credit cards VS AmEx). Thus they never have to rely on their provider having the right brand partnerships. As they are dealing with only one BNPL, there is one, clear payment timeline and one easy-to-use platform to keep track of all their spending.

The ‘new world’ of credit is one with responsibility at it’s very core. Customers will never be undermined or tricked by nasty hidden fees and high interest rates and services and payment timelines will be more streamlined than ever before. At Zilch the view is: if someone misses a payment, it’s largely a failure on behalf of the BNPL provider – not the customer.