Source: Business Telegraph

Zilch is now the only FCA regulated BNPL provider in the UK.

Buy-Now-Pay-Later (BNPL) companies flourished last year at the hands of coronavirus. Following the November lockdown, thousands of Brits felt the financial impact of the pandemic and signed up for BNPL providers to spread the cost of their shopping, especially over a cash-strapped Christmas period. But some providers have been known to catch shoppers out with hidden costs and loopholes, which have led many shoppers to fall into serious debt. As a result, the Financial Conduct Authority (FCA) has taken much-needed steps to tighten its regulations and protect consumers. Their new regulations came into force on 4th February.

Of course, many shoppers rely on BNPL providers to finance their purchases, which is problematic given that the new regulations could stop most providers in their tracks. These providers must now adapt their services to meet the new regulations. But this will require work, and BNPL providers will struggle to achieve this immediately. Now, the only BNPL provider that currently fulfils the FCA’s new criteria is the pioneering UK Fintech company Zilch.

It’s no surprise that shoppers throughout the UK are signing up in their thousands to spread their costs with the innovative BNPL provider, especially now that Zilch’s competitors have serious work to do. Zilch has gained much traction in the UK over the past year. Many shoppers opt for the provider over its competitors to enjoy its six-week financing schedule, which is easy to use and doesn’t hit customers with late fees or other hidden costs.

Zilch’s Customer-Focused Ethos

Zilch gained its FCA licence after 12 months of intensive work with the financial regulator as part of the Regulatory Sandbox Programme. As one of the UK’s first fully FCA-regulated BNPL providers, Zilch emphasises that lenders should always ensure they never put customers at financial risk. Zilch’s ethos is if a customer misses a payment, then that’s their fault as a business – they have failed their customers by lending money they should have. It’s this way of thinking that makes Zilch particularly responsible when it comes to looking after its customers’ financial needs.

“Zilch was built with customer affordability at the forefront of everything we do, and we have been working towards this point since our conception,” said Zilch founder and CEO Philip Belamant. “Securing our consumer credit authorisation with the FCA is another step towards improving consumer financial wellness and removing credit-related anxiety for our customers.”

The FCA’s New Regulations

The FCA’s efforts to improve unsecured credit market regulations follow the newly released Woolard Review, which highlights the huge increase in demand for BNPL solutions over the last year. The FCA’s updated regulations include 26 new recommendations to protect shoppers. These recommendations request the following:

New regulations

More debt advice services

Collaboration between the government and the FCA

Reformed regulation of community development finance institutions and credit unions

More alternatives to high-cost credits

Charles Randell, FCA chair is quoted within the report saying, [1] “Unaffordable credit can damage the lives of people who are already struggling to manage everyday expenses. It stands to reason that Zilch supports and welcomes the calls for regulation across the industry.“ Philip adds, “Responsibility must be at the heart of lending, with no exceptions. Zilch was born with regulation at its core. It has been part of our DNA from the start, and that has resulted in us being the first fully FCA regulated [BNPL] provider in the UK.”

– ENDS –

About Zilch

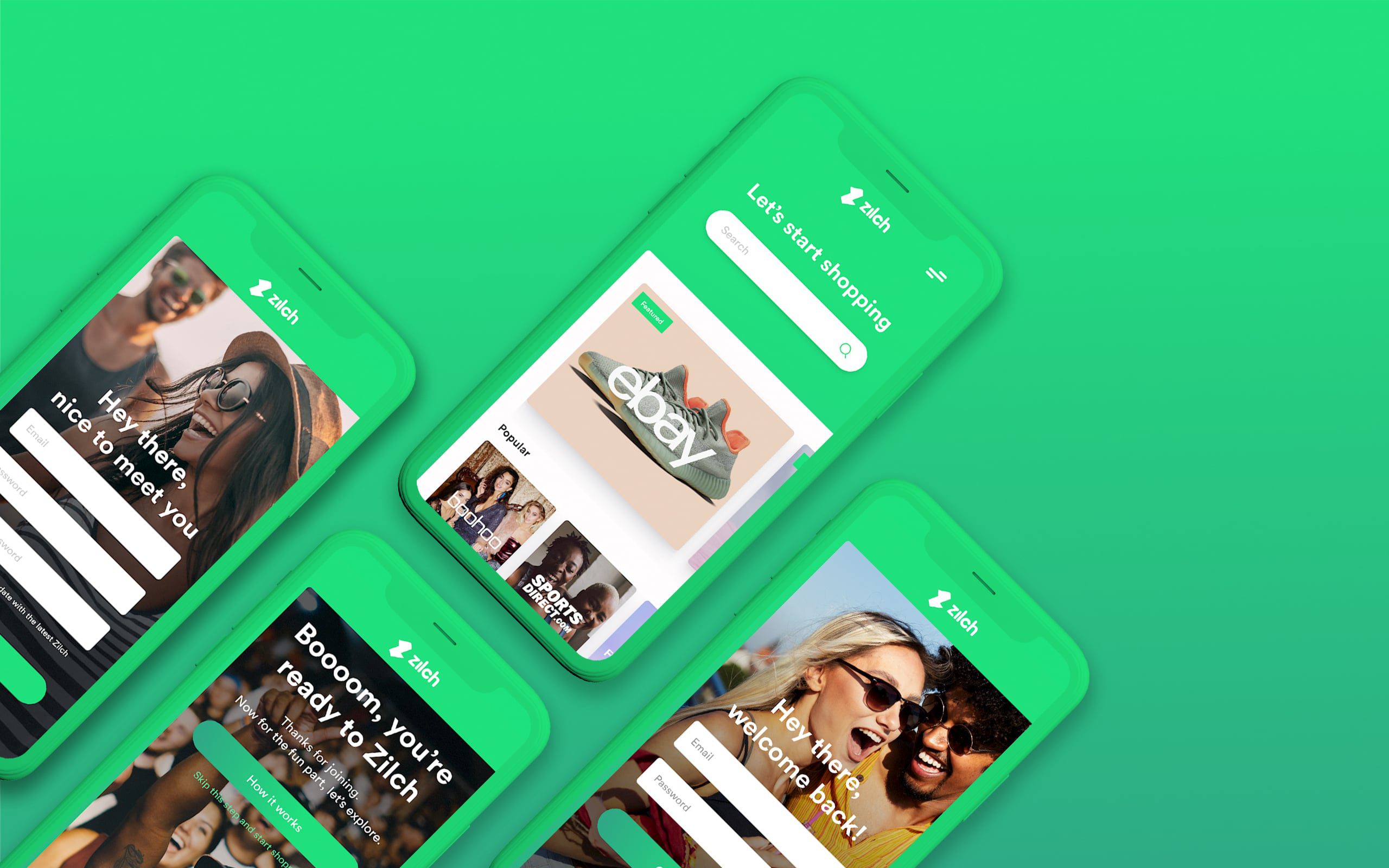

Having now rolled out a $30m fund to scale its unique BNPL model, Zilch is well-positioned to assist customers as they spread their payments to finance their shopping without the risk of debt. Customers can use Zilch’s virtual card to shop online anywhere that offers MasterCard payments, including Amazon, eBay, Nike, Boohoo, and ASOS, amongst other major players in the retail space. As more customers turn to Zilch to finance their shopping, the BNPL provider is now likely to become the next fintech unicorn. Signing up for Zilch’s virtual MasterCard is easy. You can create an account in just a few clicks and start shopping immediately. You can sign up for Zilch at www.payzilch.com.